Calculate income tax per paycheck

For a hypothetical employee with 1500 in weekly. To determine your hourly gross rate of pay divide your annual salary by 52176 to obtain the weekly rate and then by the number of hours in your standard work week.

Understanding Your Paycheck

250 and subtract the refund adjust amount from that.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Starting with your salary of 40000 your standard deduction of 12950 is deducted the personal exemption of 4050 is eliminated for 20182025. Get Started Today with 2 Months Free.

1 plus 300 school. How It Works. Ad Easily Approve Automated Matching Suggestions or Make Changes and Additions.

This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income. Use this tool to. Estimate your federal income tax withholding.

Calculate your paycheck in 5 steps Step 1 Filing status. The information you give your employer on. Your average tax rate is 220 and your marginal tax rate is 353.

Multiply the hourly wage by the number. The amount of income tax your employer withholds from your regular pay depends on two things. Step 2 Adjusted.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Here is a list of the various deductions considered under income tax laws to calculate income tax on salary. The amount you earn. 250 minus 200 50.

Census Bureau Counties that have local income taxes. Refer to employee withholding certificates and current tax brackets to calculate federal income tax. See how your refund take-home pay or tax due are affected by withholding amount.

Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. How to calculate taxes taken out of a paycheck.

This number is the gross pay per pay period. Your average tax rate. Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

That result is the tax withholding amount. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Get Your Quote Today with SurePayroll.

This makes your total taxable. Some calculators may use taxable income when calculating the average. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

How do I calculate salary to hourly wage. Subtract any deductions and. For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

All Services Backed by Tax Guarantee. Various deductions to calculate income tax on salary. Your marital status and whether you have any dependent will determine your filing status.

Then look at your last paychecks tax withholding amount eg. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Iowa Paycheck Quick Facts.

That means that your net pay will be 43041 per year or 3587 per month. Iowa income tax rate.

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Paycheck Calculator Take Home Pay Calculator

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

How To Calculate Federal Income Tax

Paycheck Tax Calculator Discount 57 Off Www Wtashows Com

How To Calculate 2019 Federal Income Withhold Manually

Free Online Paycheck Calculator Calculate Take Home Pay 2022

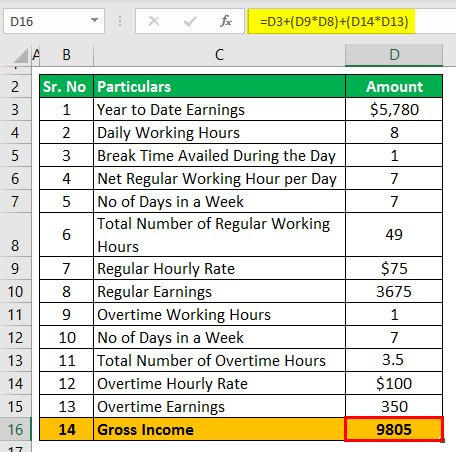

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Withholding Tax Youtube

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Net Pay Definition And How To Calculate Business Terms

Hourly Paycheck Calculator Step By Step With Examples